The Government has a Spending Problem

As posted on the Strawberry Newswire, 8/3/2023

The U.S. government was just knocked down a peg...

In a historic move, credit-ratings agency Fitch Ratings downgraded the U.S.'s credit rating from AAA to AA+.

This sent a wave of concern across global markets, as this is only the second time such an event has happened. The first time America's credit rating was downgraded was back in 2011 at the hands of S&P Global Ratings.

In 2011, the economy was still fragile coming out of the global financial crisis. Today, despite the substantial inflationary pressures we've seen over the past year, the economy has continued to display fundamental strength.

According to Fitch, the downgrade is a result of the deterioration in "governance," which has led to a loss of confidence in the government's fiscal responsibility. This includes concerns over tax cuts, excessive spending initiatives, and economic uncertainty – all of which are projected to damage the country's finances over the next three years.

In other words, Fitch believes the government has been irresponsible with the way it has handled the nation's finances. And because of this negligence, it no longer trusts the government's ability to pay back its debt and maintain its obligations.

To make matters worse, the U.S.'s weakening financial situation has only accelerated due to the onslaught of partisan policies over the past decade. This partisan divide in Washington, D.C. is particularly to blame for the government's ever-growing debt ceiling and last-minute resolutions.

According to Mike Skordeles, senior U.S. macro strategist at Truist Advisory Services, the downgrade is a "political warning shot" fired by Fitch to get the attention of those on both sides of the political aisle.

Global markets and investors reacted swiftly following the news of the downgrade, with risk assets falling and long-term bonds selling off. However, history suggests that the immediate panic may be short-lived.

The actual concern for investors rests in the rationale behind the decision.

You see, the downgrade points to a larger underlying issue – rising government debt in the face of high interest rates and prolonged economic stagnation.

Fitch projects that the government deficit as a percentage of gross domestic product ("GDP") will rise to 6.3% this year... a steep increase from last year's 3.7%.

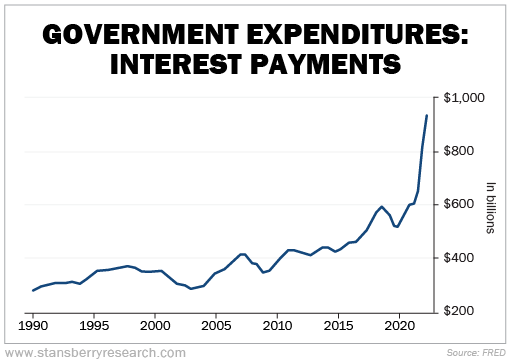

And within two quarters, U.S. interest payments are expected to surpass $1 trillion for the first time ever...

One of the government's largest expenditures won't be for social welfare or defense spending... but instead for interest on money already spent.

This should be enough of a black eye to the U.S.'s reputation that the government would correct course with a more sustainable spending pattern.

Ultimately, the credit downgrade underscores a flawed governance system. It is merely a symptom of a larger issue plaguing the U.S. government. The fundamental problem lies within the steady erosion of responsible spending.

Despite all of this, the U.S. remains one of the world's largest and most dynamic economies. So far, it has managed to avoid any sizable slowdown this year – even in the face of moderate inflation and high interest rates.

But the economy is not immune to monetary and fiscal policies enacted by the Federal Reserve or Congress. And it can only withstand financial malpractice for so long before a major credit event (or crisis) occurs...

It's possible that politicians solve their spending problem and restore confidence in the eyes of the public. But I'm not holding my breath.