Gradually then Suddenly

Prelude from PWA Financial: Comments made by Federal Reserve Chairman Jerome Powell, after this week's Central Bank Committee meeting, have refueled the "hard landing," "soft landing," "no landing" debate on the condition of our economy. After months of complacent market reaction to Powell's promise of "higher rates for longer," this week's comments and revised interest rate projections have struck a nerve. Will higher rates for longer actually smother economic growth, corporate profits, and extinguish the white-hot employment market? Is a recession imminent? There are plenty of arguments for all possible outcomes. What follows is an observation by the folks at Stansberry NewsWire. They see a real problem already brewing. Take a look…

'Gradually, Then Suddenly… a Recession is Here'

As published in the September 22, 2023 Stansberry NewsWire

Early yesterday morning, I sat at my desk deep in thought, with my usual breakfast routine far from the mind.

I was consumed with the latest Federal Reserve policy decision and mulling over all the possible consequences.

One scenario in particular stuck out to me. And today, I’m going to dive into a particular corner of the economy that has me worried...

To briefly recap, the Fed did exactly what all of us expected: pausing rate hikes for the second time this year – and keeping the benchmark rate at 5.5%.

But as anyone would tell you, investors were more eagerly awaiting Fed Chairman Jerome Powell's post-meeting comments in conjunction with the Fed's quarterly Summary of Economic Projections.

Our very own Corey McLaughlin detailed the changes to the outlook in Wednesday's Digest...

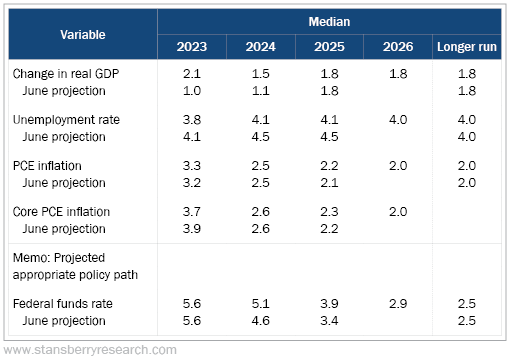

In its Summary of Economic Projections, or SEP, the Fed members predicted stronger real GDP growth (2.1% in 2023, double its 1% guess in June), a lower unemployment rate (3.8%, down from a 4.1% prediction in June), and slightly lower core inflation (3.7% for the rest of this year, versus a 3.9% projection three months ago).

At the same time, though, the central bankers are projecting the Fed's benchmark lending rate to stay above 5% throughout next year, though with a slight 50-basis-point cut. It's also predicting around a 4% fed-funds rate in 2025, half a percentage point higher than its projection three months ago...

Take a look at the table below detailing the full projections...

For months, the central bank has been force-feeding investors this "higher for longer" mantra. And for the longest time, the markets just weren't buying it.

But maybe they will now.

As you can see in the table above, the Fed's median projection for interest rates doesn't fall below 4% until 2025.

It's a scenario similar to the one I described just a week ago...

I believe the Fed will hold to its "higher for longer" mantra – as it has done for the last year now...

...The Fed is playing the long game. As most folks know, that last 10% – that final push – is always the hardest. And if you ask me, the Fed's final push might just send the economy into a recession.

Even Powell admitted that the vaunted "soft landing" is basically off the table. And that was in response to a question asking if a soft landing should be considered the baseline expectation…

No, no, I would not do that.

And all I could think was, "He finally said the quiet part out loud!"

But that's not what I was mostly worried about. You see, in the Fed's latest forecast, it delayed the first projected rate cut in June 2024 to September 2024.

That's exactly one year away... until some relief is in sight for homebuyers, consumer debt, and banks' balance sheets...

But at the same time, my mind was racing with possibilities of how things could turn ugly.

I couldn't help but think of a conversation between two characters in an Ernest Hemingway novel. It started with the question "How did you go bankrupt?" And the answer was:

Two ways. Gradually, then suddenly.

You see, Hemingway is right. It is so easy to ignore the red flags early on when things don't 'seem' bad.

Then, before you know it, the wheels have fully come off.

An economic soft landing has happened (arguably) only one time in history. And there's a reason for it...

It's that the Fed just can't accomplish its goal of vanquishing crippling inflation without breaking something else in the economy.

Now as I mentioned above, I see many risk factors out there right now. But today, I really want to focus on the housing market...

U.S. News & World Report recently conducted a nationwide survey of 1,200 Americans who had bought a house in the past year. It asked those folks about mortgage rates, future plans, and how they felt about taking out a mortgage at such high rates a year ago.

Here's what they found:

Most recent homebuyers (82%) were assured they could "buy now and refinance later."

The vast majority (84%) plan on refinancing to a lower rate in the future.

Over half of recent buyers (55%) regret taking out a mortgage when rates were high.

What stood out to me the most were the first two statistics.

Over the past year, mortgage rates have averaged between 6% and 7%. That's very high compared with the past decade.

And as recently as 2019, homeowners were refinancing in droves, taking advantage of rates below 3%.

Call it recency bias, but it seems that many homebuyers were expecting to only pay a substantially high monthly payment for a short period of time.

But what I found most distressing were the following results...

When asked how low rates would need to fall for them to refinance, 43% of respondents said between 5.5% and 6%.

And 13% say they won't be able to keep making payments if they can't refinance – among borrowers with an adjustable-rate mortgage, that figure is higher at 16%.

Why is this troubling?

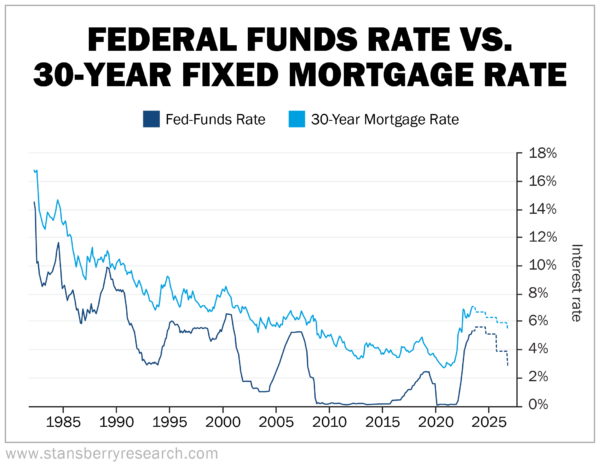

Well, we should expect interest rates to stay higher for longer. But when interest rates start falling, we shouldn't expect mortgage rates to drop by the same amount.

Meaning, just because the Fed cuts interest rates by 50 basis points, your lender isn't going to give you the same break.

In fact, it'll probably be a much smaller drop in mortgage rates...

I went back to look at how the average 30-year fixed mortgage rate fared following a peak in interest rates during each of the last three recessions (excluding 2020).

Using data from three periods (i.e., 1989 to 1992, 2000 to 2002, and 2007 to 2009), I found that on average, the 30-year fixed mortgage rate falls only 21.5% from the date the fed-funds rate peaks to when the Fed stops its rate cuts.

Meanwhile, the fed-funds rate fell 80.4% from its peak during this easing period.

So, given the most recent Fed projections – and the historical chasm between the average declines in mortgage and interest rates – homeowners shouldn't expect to refinance with a sub-5.5% mortgage rate anytime soon.

Take a look...

Even if interest rates see a decent-sized drop over the next few years, it won't be the same for mortgage rates. That's not much relief for homeowners, especially since their finances are already spread thin.

While I believe that interest rates would need to stay higher for longer than most would have thought, I will admit that this latest projection seems just a bit too long.

Frankly, with rates this high in these economic conditions, something is bound to "break" sooner than later. And it could all happen "gradually, then suddenly."