Inflation - Persistent

Core and Headline Consumer Price Index (January 2023)

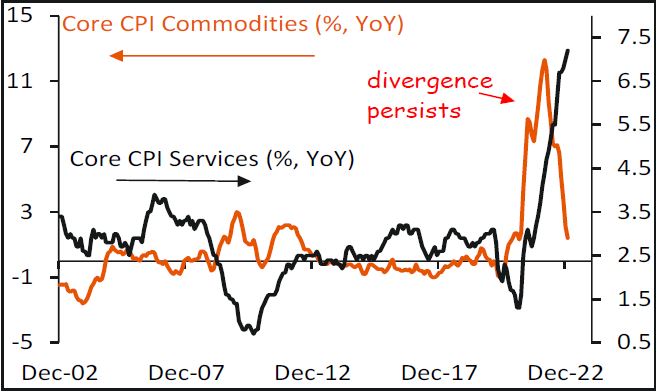

Core Services Inflation Keeps Rising

-

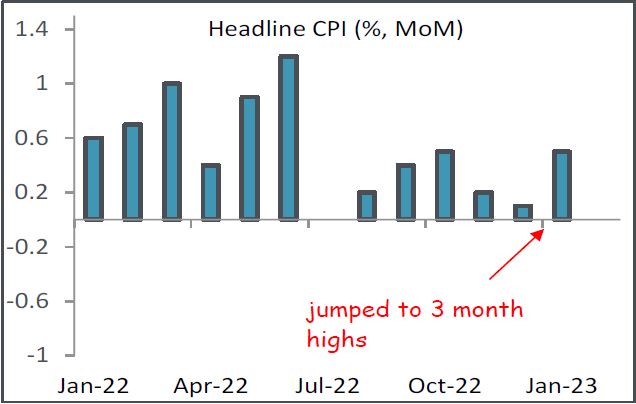

Monthly headline CPI came in at 0.5% MoM, meeting expectations

-

Core CPI printed at 0.4% MoM, also right on top of market expectations

-

Energy related costs were up 2.0% MoM, followed by a 0.9% MoM increase in transportation

-

Shelter costs, which account for 34% of CPI, rose by 0.7% MoM

-

Over the past 12 months headline and core CPI increased by 6.4% YoY and 5.6% YoY

Bottom line: After decelerating in the prior two months headline inflation picked up momentum in January, increasing by 0.5% MoM after rising by only 0.1% MoM in December (top left chart). On the other hand, core inflation was unchanged at 0.4% MoM compared to the prior month, rising for the 32nd month in a row. On annual basis, headline and core CPI posted their 7th and 4th consecutive declines maintaining their downward trend and are now down by 2.7% and 1% from their peak levels (top right chart). Looking at the underlying details, shelter costs contributed more than 50% to headline CPI with annual housing costs jumping to a new historically high level (bottom left chart). Americans also paid more for food, fuel, and auto insurance, but did pay less for used cars/trucks, medical care, and airline fares. With private sector measures of rent growth having peaked 6 to 9 months ago, shelter costs should be less of a headwind in the months ahead given the lag between real-time data and the CPI report. However, in the near term, the sustained divergence between services and goods price pressures will keep the Fed cautious in its outlook for inflation (bottom right chart), as core services rose to their highest level since 1982.

AUTHORS: Dimitri N. Delis, Ph.D. Managing Director 312 267-5158