The Road Ahead

Note from Ken Coniglio:

John P. Calamos, Sr. is the Founder, Chairman and Global Chief Investment Officer of Calamos Securities. I have been using funds and products offered by Calamos in PWA Financial clients’ portfolios for over a decade because Calamos has consistently provided superior performance and thought leadership over multiple market cycles. John has graciously agreed to allow me to share his 2022/2023 Review and Preview with our clients. John’s opinion remains consistent with my point of view on what has lead us to the point we are at today, and more importantly, John shares my fervent belief that the best approach to follow in this difficult environment is to remain focused on security selection (active management), fundamentals, to embrace quality, and very importantly – to remain diversified.

Calamos Investment Team: Review and Outlook Introduction by John P. Calamos, Sr.

Note: Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

January 3, 2023

-

Our teams are finding cause for cautious optimism as inflationary headwinds weaken.

-

In contrast to 2022’s macro-driven environment, we expect markets in 2023 to reflect an increased appreciation for a company’s fundamentals. This can provide a more hospitable environment for our active approaches and bottom-up security selection.

-

Our teams are identifying opportunities across assets classes, guided by fundamental research and time-tested processes.

In 2022, the US equity market saw its highest level on the first trading day of the year. From there, a confluence of factors created a challenging backdrop for risk assets, including stocks, bonds and convertible securities. Indeed, it was often noted that there was nowhere to hide. The turbulent environment reflected the market’s singular focus on macro considerations, most notably the Federal Reserve’s decision to go “all-in” to try to stop inflation. This move dealt an especially painfully blow to longer duration assets like growth companies. In addition, investors grappled with the implications of the war in Ukraine, Covid lockdowns in China, global supply chain disruptions, and US fiscal policy uncertainty. This all-in or all-out analysis caused markets to swing widely, and only a few companies were able to move against the tides.

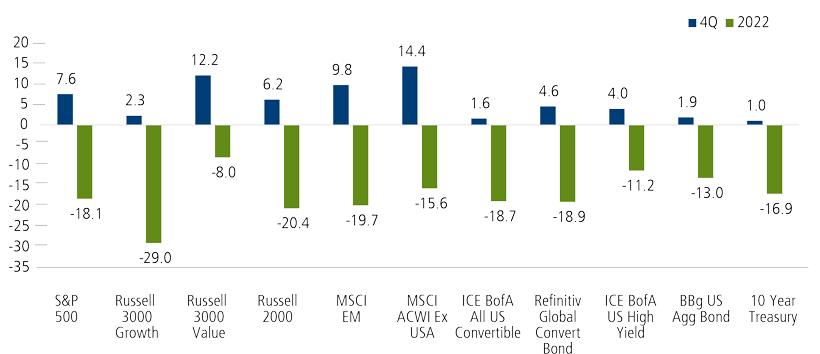

Although market participants remained jittery, sentiment improved as the year came to a close. During the fourth quarter, global markets advanced, supported by the prospect of slowing inflation later in 2023 and an eventual moderation of rate hikes. Investors also cheered solid corporate earnings and China’s long-awaited loosening of Covid restrictions.

The fourth quarter brought a brighter close to a dismal year

Asset Class Performance, Total Return %

Past performance is no guarantee of future results. Source: Morningstar.

Macro themes and valuations will remain important in 2023, but we anticipate markets to expand their focus on company fundamentals (e.g., growth prospects). This increased attention to fundamentals should provide tailwinds for our teams’ active and research-driven approaches. We remain focused on security selection, understanding the macro picture, and identifying themes that can help propel individual industries and companies forward. We believe this approach positions us well given the likelihood of choppy markets and the potential for rolling bear markets, where some sectors fall and others rise.

A lot of investors have recently asked me how long it will be before things get back to “normal.” The reality is that the economy, the markets, the inflation backdrop, and the interest rate environment will never be static. The economy and the market are two different (but related) things, and their cycles have historically played out differently. For example, recessions can vary significantly, in terms of their catalysts, durations and depth—with some being quite short and shallow.

What’s most important to remember is this: there are always investment opportunities, wherever we are in the market or economic cycle. This is a lesson I learned early in my investing career in the 1970s, a period similar to today, with high inflation, stock and bond markets under pressure, fiscal policy headwinds, and geopolitical uncertainties. The stock market traded sideways for many years, but there were still opportunities where fundamentals and valuations provided the bedrock for attractive investments.

With so much volatility and uncertainty on the horizon today, I encourage investors to stay focused on diversification. Looking longer-term and layering in opportunistic allocations over the coming months is a far better approach than trying to trade in and out of the market on a short-term basis. There is compelling potential in many parts of the market, including areas that were oversold in 2022—such as growth stocks with good earnings. This opportunity set includes a number of technology companies, which came under stiff pressure despite having strong balance sheets and cash flows and innovative products and services—crucial drivers of long-term growth. Market cap diversification also makes sense, especially as many small caps are supported by low relative valuations and strong growth fundamentals. Meanwhile, as we move away from the abnormally low rates of past years, I believe investors will be well served by maintaining and adding allocations to fixed income approaches, such as our short-term bond strategy.

Finally, it’s exciting to see alternative strategies, such as long/short equity and market neutral strategies, continue to gain traction in mainstream asset allocations, which I believe is a positive trend.

As active managers, the Calamos teams do not invest in the economy, the market, or an index—we invest in individual securities, which gives us a valuable advantage. In the commentaries that follow, our teams will explain where they are finding opportunities and how they are managing the risks they see today.