Why I’m still optimistic Heading into 2024

|

Today’s economic landscape leaves much to be desired.

In the U.S., we're grappling with...

- High interest rates due to four-decade-high inflation,

- A sluggish market recovery outside of the "Magnificent Seven,"

-

The deepest bond bear market in history,

-

A looming presidential election,

-

And war in Ukraine and Israel.

We're navigating a complex landscape of economic uncertainty, shifting markets, geopolitical tension, and volatile domestic politics.

It's no surprise that, in recent months, I've had countless conversations with friends and colleagues – and inquiries from our readers – who are desperate to find anything reliable to hang their hat on in these uncertain times... worried about what lies ahead for the market.

The phrase "significant moments in history" might be somewhat clichéd, yet it undeniably captures the essence of our current reality. We find ourselves navigating a complex landscape where the true impact of events often becomes clearer only with the passage of time.

This is exactly when we turn to history to see what the future may hold.

So today, we'll look at how past markets have responded to some of the events taking place at present. We'll look at data from past major geopolitical shocks, bear markets, and presidential elections.

This will allow us to better gauge what the coming months and years have in store for the market. And as you'll see, there are still reasons to be optimistic...

(Please note: Market data in today's issue was sourced from Carson Investment Research.)

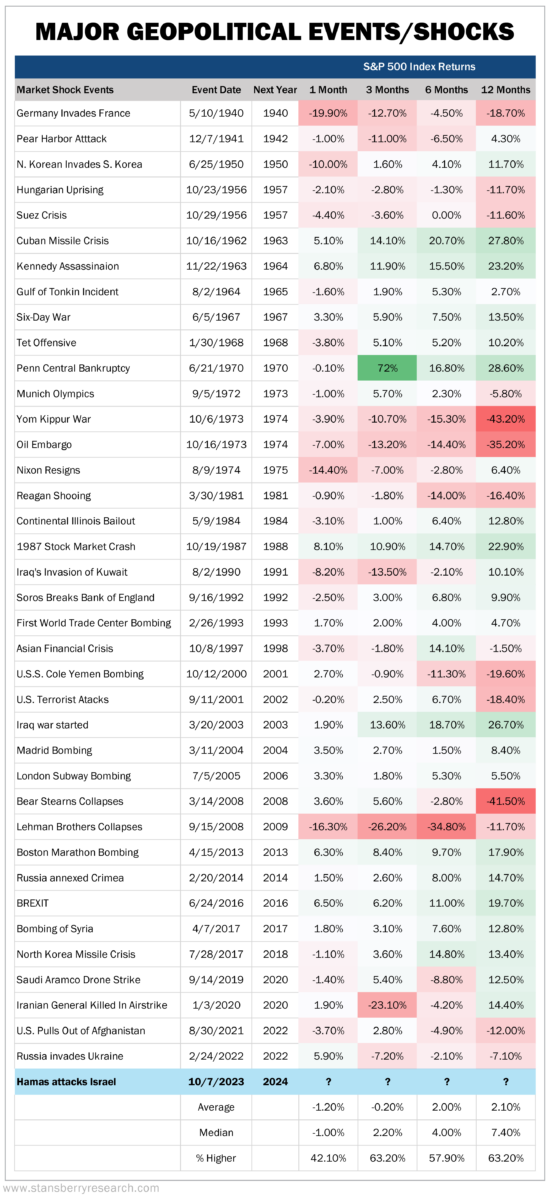

MAJOR GEOPOLITICAL EVENTS/SHOCKS

This past weekend, Israel was besieged by Hamas terrorists, igniting the second major regional war in as many years.

So far, markets have been relatively muted with the only major significant movement coming in the bond markets on Tuesday, which saw yields fall and prices rise as investors turned toward these typically "safe haven" investments.

So far, markets have been relatively muted with the only major significant movement coming in the bond markets on Tuesday, which saw yields fall and prices rise as investors turned toward these typically "safe haven" investments.

Below you can see the market performance following every major event dating back to 1940.

Check it out...

In the second year following a bear market, the median return was double the market's historical average annual price return of about 7%.

The good news is that in 1989, we saw the market's largest second-year return, at 29%.

The good news is that in 1989, we saw the market's largest second-year return, at 29%.

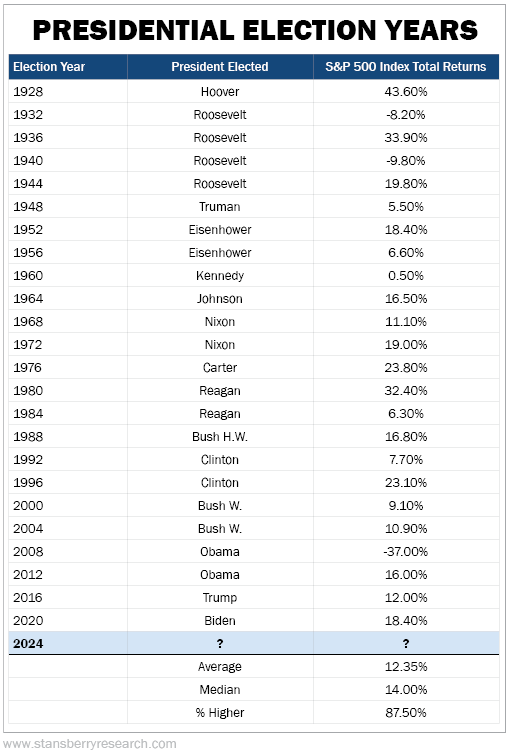

PRESIDENTIAL ELECTION YEARS

I often hear that election years are terrible for the market.

A lot of that is perception rather than reality...

Check it out...

Nearly nine out of 10 election years see a positive return for markets, with the median doubling the historical average annual price return of about 7%.

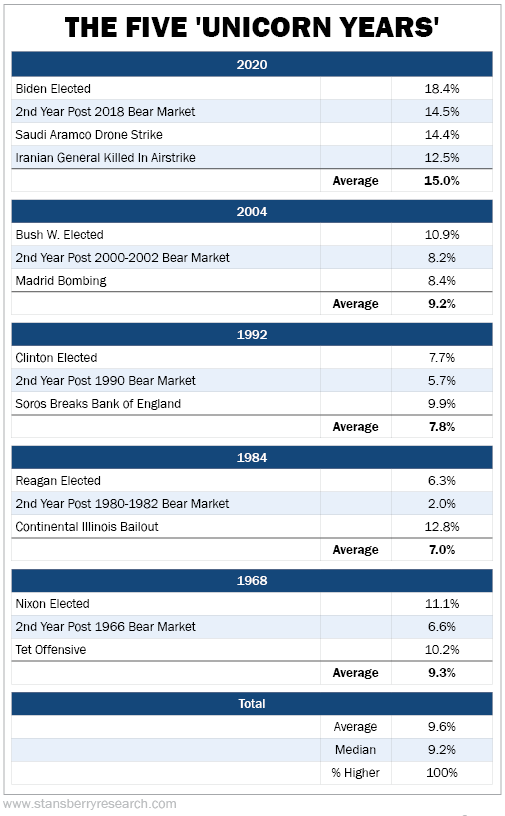

So, according to history, it's not all "doom and gloom" for the markets after these different events. But what about when these three events are happening at the same time?

There have been five times in which we've seen a geopolitical shock, a bear market, and a presidential election within the relative same 12-month period... 2020, 2004, 1992, 1984, and 1968.

(In this analysis, if the 12-month period of the second year post-bear market or geopolitical shock occurred for more than six months within the presidential year, it was included.)

Check it out...

As you can see, even in these "unicorn years" where all three events took place within the span of a year, the market still shows tremendous growth potential, with the median and average beating the market's historical average annual price return of about 7%.

Now, of course, every scenario offers its own unique set of challenges. These historical figures aren't meant to serve as a predictor of future success. They can only serve as guardrails for investors trying to gauge the path forward.

But the data tells us that even in tumultuous times such as today, the market has proven resilient... and that there's still potential for growth heading into 2024.