Stay Calm, Stay in, Stay the Course

Stay in to Win

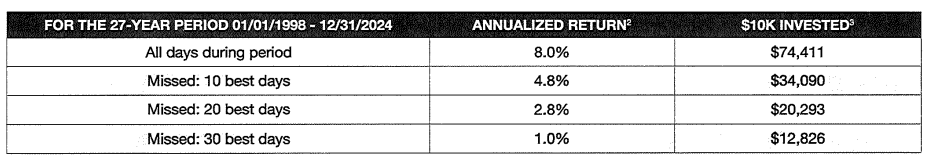

An investor who exited the market and subsequently missed just 10 of the best-performing days in the past 27 years would have lost out on more than half of the gains. Given the difficulty of market-timing, a far better course would have been to stay in, with the knowledge that volatility is normal and that missed upside can dramatically cut into long-term returns.

MISSING THE BEST-PERFORMING DAYS OF THE MARKET CAN HAVE A SIGNIFICANT IMPACT ON YOUR PORTFOLIO

S&P 500 annualized returns, January 1, 1998- December 31, 2024

Source: Morningstar. Standard & Poor's.

1The "best" days to be invested are defined as the days on which the S&P 500 Index delivered its highest returns for the given periods based on historical

data. 2Returns are measured based on the S&P 500 Index. 3This illustration depicts the value of a hypothetical $10,000 investment in the S&P 500 Index

from January 1, 1998, through December 31, 2024. Note: The historical data are for illustrative purposes only and do not represent the performance

of any specific portfolio managed by Lord Abbett or any particular investment, and are not intended to predict or depict future results. Indexes are

unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment. Past performance is not a reliable indicator

or guarantee of future results.

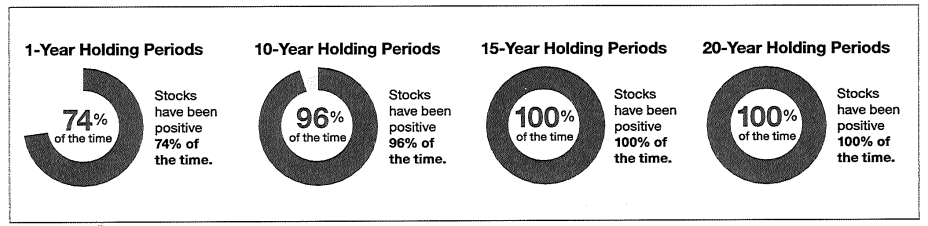

STAY THE COURSE

For long-term equity investors, the most powerful factor is time: historically speaking, an investor's time horizon is directly correlated with the likelihood that a portfolio will experience positive returns. For these long-term investors, staying the course is the most critical consideration when trying to build wealth and meet their investment objectives.

THE LONGER YOU STAY IN THE MARKET, THE GREATER THE POTENTIAL FOR A POSITIVE OUTCOME

S&P 500 Index returns in calendar-year periods, 1927-2024

Source: Morningstar.

Note: The historical data are for illustrative purposes only, do not represent the performance of any specific portfolio managed by Lord Abbett or any

particular investment, and are not intended to predict or depict future results. Indexes are unmanaged, do not reflect the deduction of fees or expenses,

and are not available for direct investment. Past performance is not a reliable indicator or guarantee of future results.